iowa lottery tax calculator

For one thing you can use our odds calculator to find the lotteries with the best chances of winning. Claiming Your Prize Game Info Jackpots InactiveExpired Tickets Lotto Game Do I have to pay taxes on my winnings.

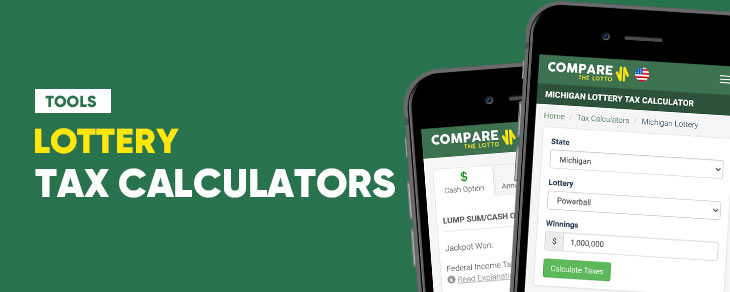

Usa Lottery Tax Calculators Comparethelotto Com

Nonresidents are required to file an Iowa return if Iowa-source income.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/NCIRIAKRJZOZNCHUAVHXW5D5DA.jpg)

. You may then be eligible for a refund or have to pay more. Iowa Lottery Tax Calculator. This also applies to winnings from a multi-state lottery if the tickets were purchased within the state of Iowa.

A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. Current Mega Millions Jackpot. View the 658 Lotto result 655 Lotto result 649 Lotto result 645 Lotto result 642 Lotto.

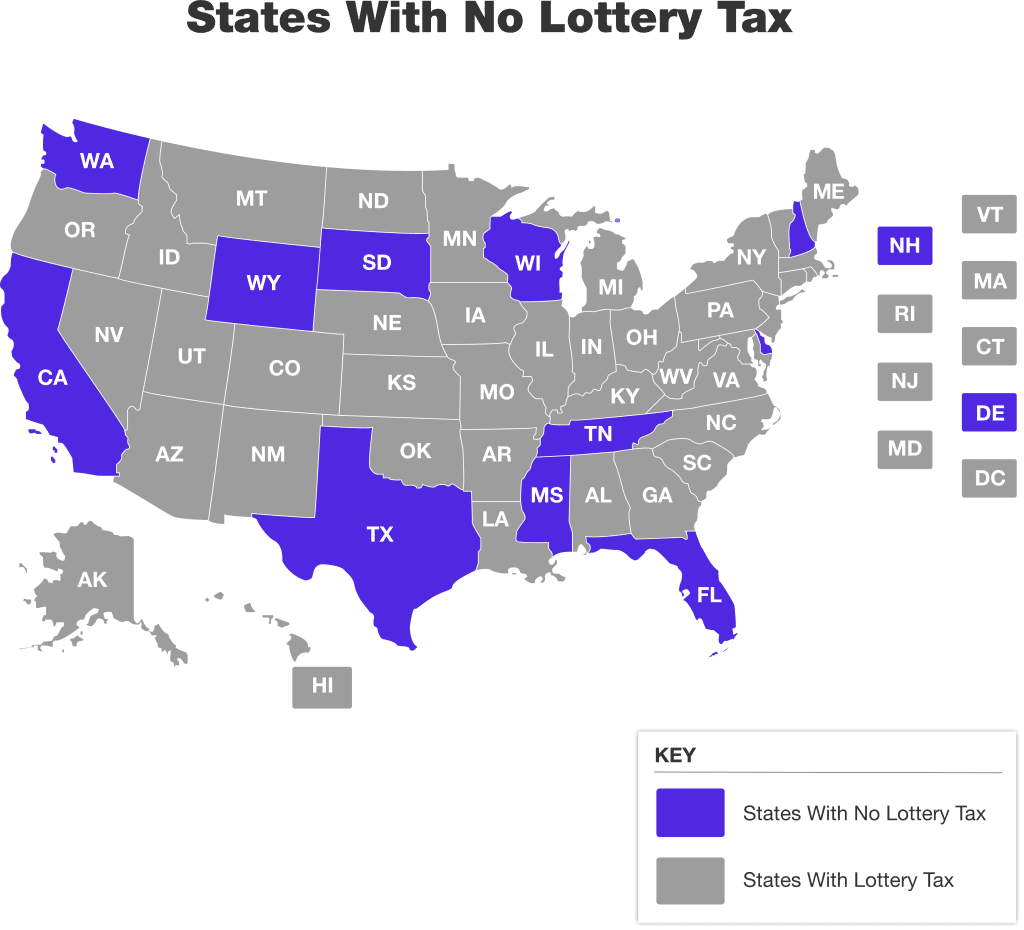

25 State Tax. 5 Kansas state tax on lottery winnings in the USA. These lottery tools are here to help you make better decisions.

A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. 323 Iowa state tax on lottery winnings in the USA. 495 Indiana 34 Iowa 5.

The Iowa Lottery makes every effort to ensure the accuracy of the winning numbers prize payouts and other information posted on the Iowa Lottery website. The Iowa tax that must be withheld is computed and paid under. Our Mega Millions calculator takes into account the federal and state tax rates and calculates payouts for both lump-sum cash and annual payment options so you can compare the two.

23 You must be 21 years or older to play Video Lottery The 10 Best Mass Lottery Scratch Tickets This Month. By law prizes of more than 600 will face a 5 percent state withholding tax. To understand these complicated lottery tax calculations you need to get your hands on a lottery tax calculator and hire a financial advisor to get help over tax and investment.

The Iowa Lottery does not withhold tax for prizes of 600 or less. A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money. The calculator will display the taxes owed and the net jackpot what you take home after taxes.

If a player wins more than 5000 an. 40 - 100 of taxable income in third bracket has a tax. Iowa Lottery Tax Calculator.

The 10 Best Mass Lottery. Calculate the taxes you need to pay if you win the current Powerball jackpot and more importantly how much money you will take home. Calculate your lottery lump sum or.

Tuesday Oct 18 2022. The Tax Calculator helps you to work out how much cash you will receive on your Lotto America prize once federal and state taxes have been deducted.

The Best And Worst States For Winners Of The Billion Dollar Powerball Lottery

Iowa Lottery Ia Results Winning Numbers Fun Facts

Lottery Tax Calculator What Percent Of Taxes Do You Pay If You Win The Lottery By Charles Weko Medium

Lottery Payout Options Annuity Vs Lump Sum

Lottery Calculator The Turbotax Blog

Are Lottery Winnings Taxed A Quick Guide Lottery Critic

Iowa Lottery Revenue Up More Than 14 Wqad Com

Top 5 Best And Worst States To Win The Lottery

Lottery Calculator The Turbotax Blog

The Best And Worst States For Winners Of The Billion Dollar Powerball Lottery

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Michigan Lottery Tax Calculator Comparethelotto Com

Comparethelotto Usa Lottery Odds Calculators Results And More

Free Gambling Winnings Tax Calculator All 50 Us States

Lottery Tax Calculator Updated 2022 Lottery N Go

Tennessee Sales Tax Rate Rates Calculator Avalara

Vaccine Lottery Taxes On Lottery Winnings Tax Foundation

Best Lottery Tax Calculator Updated 2022 Mega Millions Powerball Lotto Tax