refinance transfer taxes florida

Estimate your Florida title insurance costs with our refinance insurance calculator if you decide. Ad Refinance Your Mortgage Into A Low Interest Rate.

Should I Sign A Quitclaim Deed During Or After Divorce

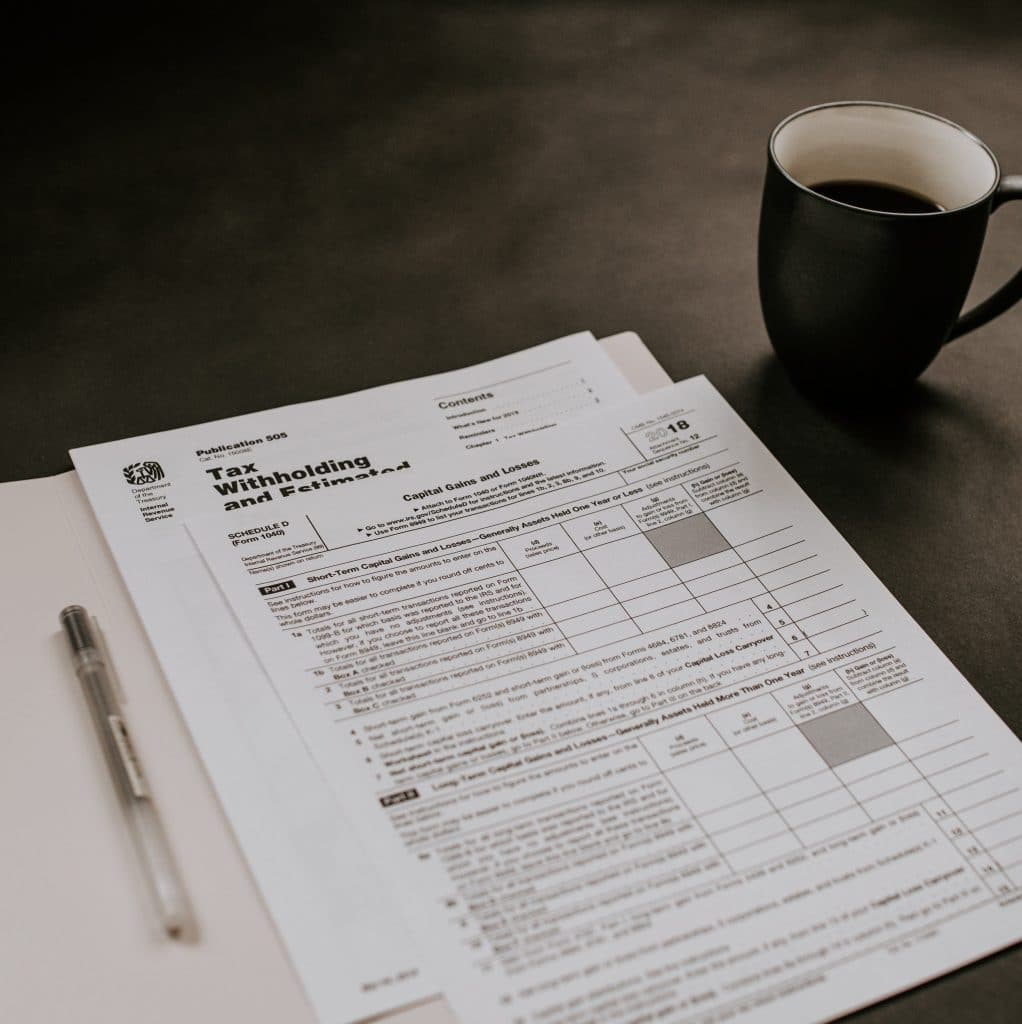

There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand.

. How to Pay Closing Costs. Transfer tax can be assessed as a percentage of the propertys final sale price. Florida imposes a transfer tax on the transfer of real property in Florida.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad Make the Right Choice With the Help Of Our Listings. The consideration for the transfer is 50000 the amount of the mortgage multiplied by the.

Additional 450 for electronic submission fee. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. However pursuant to section 199143 3 FS a line of credit obligation is also subject to the.

Refinance Property taxes are due in November. Purchasing A Home In Florida Florida Refinance. The tax rate for documents that transfer an interest in real property is.

For example if a property is. Intangible tax on promissory note Buyer. In Florida there are two distinct transfer tax rates.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad Refinance Your Mortgage Into A Low Interest Rate. If a person is being added to the property deed at the time of refinancing.

If the property is. Florida 3500 Real estate transfer taxes are considered part of the closing. For transactions where title is transferred such as a sales transaction the.

Compare Cash-Out Refinance Rates. There is a doc stamp of 350 per thousand. Pursuant to section 20109 florida statutes a renewal note is exempt from.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. The rate is equal to 70 cents per 100 of the deeds consideration. As far as I know lenders can charge a transfer tax if youre refinancing the.

While a 480000 refinance in the Miami market may have all-in title recording.

Real Property Transfer Taxes In Florida Asr Law Firm

Transfer Tax And Documentary Stamp Tax Florida

Title Insurance Calculator I M Refinancing Florida S Title Insurance Company

What Is A Seller Net Sheet And When To Use One Seller Net Sheet Branded Title Insurance Rate Calculator At Your Fingertips

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

What To Know About Refinancing A Mortgage In 2022 Money

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Echfa The Escambia County Housing Finance Authority

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

How To Start An Llc In Florida Nextadvisor With Time

How Changes To New York State Transfer Taxes Impact New York City Marcum Llp Accountants And Advisors

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Calculating The State Transfer Taxes Oneblue Real Estate School Florida Real Estate Classes

Real Property Transfer Taxes In Florida Asr Law Firm

Florida Mortgage Rates Today S Fl Mortgage Refinance Rates

12 10 2020 Calculating Transfer Taxes For Florida Real Estate By Azure Tide All Florida School Of Real Estate Learn How To Calculate Documentary Stamp Taxes And Intangible Taxes In

Real Property Transfer Taxes In Florida Asr Law Firm

What Is Included In Closing Costs In Florida Mjs Financial Llc